Jingyun Wang

Here are some simplified procedures that might be helpful!

China’s State Administration for Market Regulation (“SAMR”) began issuing guidelines for simplified deregistration procedures as early as year 2016. In July 2021, a “Notice about the further refinement of simplified deregistration procedure in order to facilitate the exit of market of micro, small and medium-sized enterprises” was issued jointly by SAMR and the State Tax Bureau.

Over time, they optimized their “exchange platform for sharing information” and online platforms, which normalize and facilitate the deregistration procedure. Below, we share our practical experience by navigating through this procedural and regulatory evolution.

Criteria for simplified deregistration procedure

A market entity (excluding listed companies limited by share) that has never had credit and debt issues, or has settled all outstanding credits and debts, may apply for deregistration through simplified procedure.

The market entity must not have any outstanding expense payments due, including employee salaries, social insurance fees, other statutory compensations, payable taxes (overdue fine or penalties), or other outstanding credits or debts.

Furthermore, if the company is forced into liquidation or bankruptcy by the court, the liquidator(s) or manager(s) of the company can apply for deregistration through simplified procedure in AMR (based on the ruling). In this case, public announcement will not be necessary.

Circumstances precluding simplified deregistration procedure

Under any of the following circumstances, a market entity cannot apply for the simplified procedure:

1. FIE subject to the Special Administrative Measures for Admittance of Foreign Investment (Negative List) as prescribed by the State;

2. Being blacklisted in the “list of enterprises with abnormal operation” or the “list of enterprises with serious violation of law or low credibility”;

3. Having any equities (investment rights and interests) frozen or pledged, or having its movables being mortgaged;

4. Being under criminal investigation or subject to any administrative enforcement, judicial assistance, or administrative punishment;

5. Having any subsidiaries or branches that are not being deregistered;

6. Having initiated a simplified deregistration procedure previously that was terminated;

7. Any outstanding approval prior to deregistration required according to laws, regulations, or decisions of the State Council.

If circumstances are falling under no. 2, 3 or 5, the authority will not cancel the public announcement. The market entity can apply for deregistration when all of these three circumstances are cleared.

If the company cancels the simplified deregistration application after public announcement, it can no longer deregister through a simplified procedure. The enterprise can be dissolved through the normal deregistration procedure and the enterprise needs to issue a new public announcement.

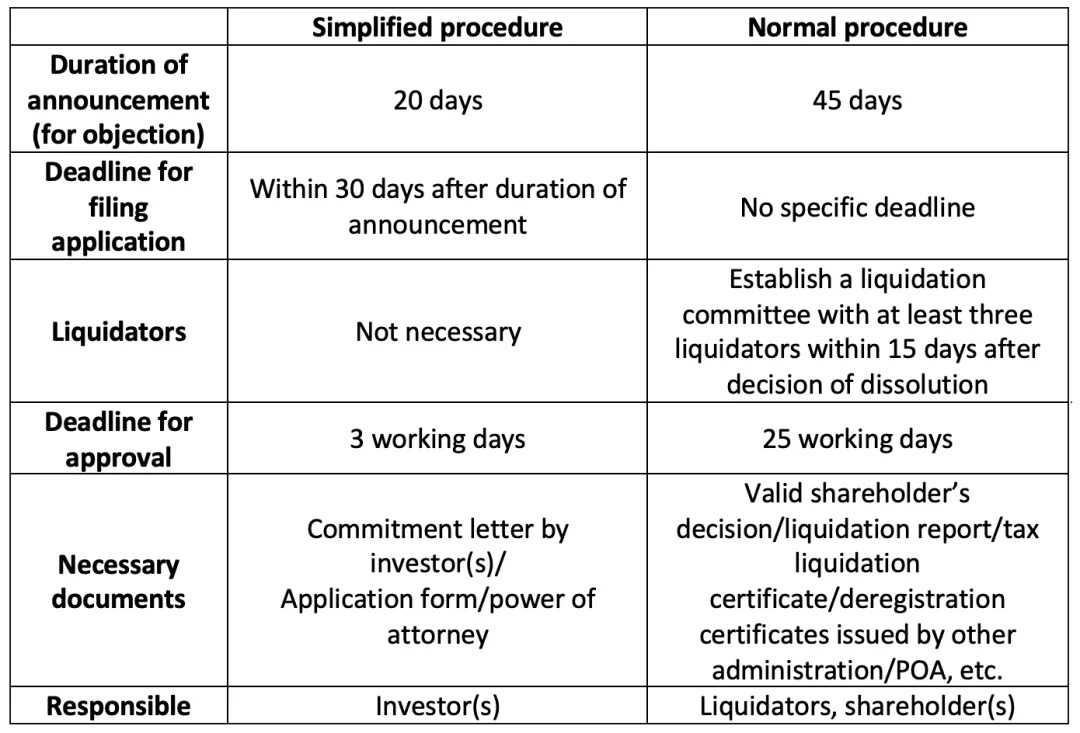

Comparison between simplified procedure and normal procedure of deregistration

Tax deregistration

According to normal procedures, the company must finish tax liquidation before deregistration with AMR. While being in a simplified deregistration proces, the market entity can deregister the company using AMR without tax deregistration under any of the following circumstances:

- The market entity has not registered with the tax bureau;

- The market entity has registered with tax bureau, but has never applied for an invoice book and has no outstanding tax filing or taxes;

- The market entity canceled and returned the invoice book during the appropriate announcement period and settled all outstanding taxes.

After the simplified deregistration in AMR, the market entity still needs to finish deregistration in tax bureau.

If any outstanding taxation issues exist, the tax bureau has the right to raise an objection during announcement period. AMR may refuse the deregistration if any such objection is lodged.

Tips for FIEs & Conclusion

Since the investor(s) of a FIE are foreign, it is not possible to do online identification and e-signatures. Therefore, FIEs still need submit the application documents on paper. Before proceeding with simplified deregistration, it is possible to have an online pre-verification in order to check whether the company passes all conditions.

Currently, there is only one way to access this online system (e-business license). If the foreign legal representative of the FIE is abroad and unable to download the e-business license, it might not be possible for the FIE to do a pre-verification. In order to avoid refusal by AMR and lose the chance to deregister through simplified procedures, we recommend closing the social insurance account, canceling any import-export licenses and concluding tax deregistration before proceeding with the simplified procedure.

Also, regarding closing bank accounts and withdrawal of balances, many banks still require documents related to the normal deregistration procedures. As such, we recommend maintaining a low balance in relevant accounts, and keeping open lines of communication with bank managers, as these will reduce complications with closing accounts and balance transfers.

Although the simplified procedures facilitate companies and investors to exit the market, investors (especially for the joint venture) should evaluate the unique circumstances of the company, and choose appropriate procedures for a market exit strategy.

Our team at DaWo has extensive experience helping clients achieve these goals, so please reach out with any questions!